UK government borrows £600m in July as tax receipts dip

Re: UK government borrows £600m in July as tax receipts dip

To be fair the rumours about his drug use appear to be obvious in that video-he does look like he's had himself a poodles leg of a line if Im to be honest.

-

Grandma Death - Mayor

- Posts: 260

- Joined: Thu Aug 23, 2012 12:04 pm

- Location: South West Wales

- Gender:

- Has thanked: 15 times

- Been thanked: 14 times

- Political Leaning: Very Liberal

Re: UK government borrows £600m in July as tax receipts dip

“Increased means and increased leisure are the two civilizers of man” - Disraeli

-

Sparse1 - Mayor

- Posts: 277

- Joined: Thu Aug 23, 2012 10:00 am

- Location: UK

- Gender:

- Has thanked: 3 times

- Been thanked: 18 times

- Political Leaning: Middle of the Road

-

Grandma Death - Mayor

- Posts: 260

- Joined: Thu Aug 23, 2012 12:04 pm

- Location: South West Wales

- Gender:

- Has thanked: 15 times

- Been thanked: 14 times

- Political Leaning: Very Liberal

Re: UK government borrows £600m in July as tax receipts dip

Cameron didn't reneg on Lords reform (another lie) they just refused to force it through without a debate. The Tory party thinks something as serious as constitutional reform should be properly debated, fancy that! So they were going to vote against the timetable and the illiberal anti-democrats threw a hissy fit.

Those are my principles, and if you don't like them... well, I have others.

-Groucho Marx

-

Clarino - VIP

- Posts: 1351

- Joined: Mon Aug 20, 2012 6:59 pm

- Location: West of the Mountains, East of the Sea

- Gender:

- Has thanked: 20 times

- Been thanked: 42 times

- Political Leaning: Middle of the Road

Re: UK government borrows £600m in July as tax receipts dip

This'll probably cheer up Cameron.

http://www.bbc.co.uk/news/business-19360966

Mark my words, by tonight Osborne's ugly mug will be all over the place proclaiming it as some sort of victory.

http://www.bbc.co.uk/news/business-19360966

Mark my words, by tonight Osborne's ugly mug will be all over the place proclaiming it as some sort of victory.

'She couldn't help wondering what use Carl had for a double bed in his bachelor establishment' - Rafferty's Legacy -Jane Corrie

- lil bit

- Senator

- Posts: 1181

- Joined: Sun Aug 19, 2012 7:45 am

- Gender:

- Has thanked: 4 times

- Been thanked: 42 times

Re: UK government borrows £600m in July as tax receipts dip

The government's deficit plan is not failing miserably, its one of the few things allowing us to borrow still at competitive rates, which is imperative as we cannot plausibly raise billions more in tax recites and thus, if we cannot borrow, we must be bailed. Something I might add the Labour party would also have acted to protect. Indeed its very easy to criticise everything in opposition as you never have to come up with an actual cohesive plan to put in action.

The real issue here ladies and gents, is that we as a small island nation throughout engaged in trade in every thing imaginable and thus, are very dependent on the world markets. No more important is our closest neighbour and biggest economic zone in the world, the E.U. The idea we can some how grow our way out of this with our own governments action alone is frankly nonsense. We simply do not have anything like the size of domestic market or current place on the world economy to in any way achieve this.

Our economy is never going to be able to really recover until and any minor improvement can be swept away (such perhaps as the last move out of recession) one of three things happens all of which will eventually result in the European markets stabilising and trade, interbank lending etc etc etc between us and them regaining confidence.

1) the euro as a single currency collapses, the majority of the world is thrown into an even more serious depression.

2) The south of Europe in effect withdraws from the euro, the euro after a period of instability stabilises, southern Europe goes through a serious depression but is able to deflate its currency to eventually get out of it.

3) Europe achieves fiscal union of a fairly strong sort. The southern European economies are brought to heel with a decade or more of austerity.

And this is nothing if China cannot achieve some sort of sustainable growth pattern. the 8% days are coming to an end.

Then there's the looming american debt crisis they keep putting off.

Government economic policy is like our economic situation hostage to world events which is it only able to effect minimally.

Even if we had, say, gone for an approach of massive government spending on 'growth projects', considering inter-bank lending is still more concerned with world markets than ever, how much that would of worked is an unknown. Furthermore, even with a total all out success and say us being at 1.5% growth for the last year maybe 0.75-1 before that, what's to say this would have held up against the euro crisis? Its all fine to continue to believe that this issue is still primarly one of a problem in the banking sector, but what it has really exposed (well people were saying this a long time ago back when it started) is the fundamentally and unstable heterogeneity of the eurozone. Moreover, with a more neo-keynsian approach of the sort advocated by Krugman we also could have ended up much further along a path the U.S is heading with our credibility as a creditor being pushed to its limit.

The real issue here ladies and gents, is that we as a small island nation throughout engaged in trade in every thing imaginable and thus, are very dependent on the world markets. No more important is our closest neighbour and biggest economic zone in the world, the E.U. The idea we can some how grow our way out of this with our own governments action alone is frankly nonsense. We simply do not have anything like the size of domestic market or current place on the world economy to in any way achieve this.

Our economy is never going to be able to really recover until and any minor improvement can be swept away (such perhaps as the last move out of recession) one of three things happens all of which will eventually result in the European markets stabilising and trade, interbank lending etc etc etc between us and them regaining confidence.

1) the euro as a single currency collapses, the majority of the world is thrown into an even more serious depression.

2) The south of Europe in effect withdraws from the euro, the euro after a period of instability stabilises, southern Europe goes through a serious depression but is able to deflate its currency to eventually get out of it.

3) Europe achieves fiscal union of a fairly strong sort. The southern European economies are brought to heel with a decade or more of austerity.

And this is nothing if China cannot achieve some sort of sustainable growth pattern. the 8% days are coming to an end.

Then there's the looming american debt crisis they keep putting off.

Government economic policy is like our economic situation hostage to world events which is it only able to effect minimally.

Even if we had, say, gone for an approach of massive government spending on 'growth projects', considering inter-bank lending is still more concerned with world markets than ever, how much that would of worked is an unknown. Furthermore, even with a total all out success and say us being at 1.5% growth for the last year maybe 0.75-1 before that, what's to say this would have held up against the euro crisis? Its all fine to continue to believe that this issue is still primarly one of a problem in the banking sector, but what it has really exposed (well people were saying this a long time ago back when it started) is the fundamentally and unstable heterogeneity of the eurozone. Moreover, with a more neo-keynsian approach of the sort advocated by Krugman we also could have ended up much further along a path the U.S is heading with our credibility as a creditor being pushed to its limit.

-

Boris Johnson - Governor

- Posts: 3341

- Joined: Fri Aug 24, 2012 4:55 am

- Location: City Hall The Queens Walk, City of London

- Gender:

- Has thanked: 117 times

- Been thanked: 190 times

- Political Leaning: Slightly Conservative

-

Grandma Death - Mayor

- Posts: 260

- Joined: Thu Aug 23, 2012 12:04 pm

- Location: South West Wales

- Gender:

- Has thanked: 15 times

- Been thanked: 14 times

- Political Leaning: Very Liberal

-

Boris Johnson - Governor

- Posts: 3341

- Joined: Fri Aug 24, 2012 4:55 am

- Location: City Hall The Queens Walk, City of London

- Gender:

- Has thanked: 117 times

- Been thanked: 190 times

- Political Leaning: Slightly Conservative

Re: UK government borrows £600m in July as tax receipts dip

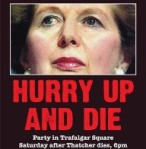

What we need is a bold and decisive leader like Thatcher at the helm. Instead, we have Dave-o and his Lib-Dem bum chums trying to compromise and half-arse their way out of the crisis. What is needed is an aggressive round of deregulation and public spending cuts coupled (very importantly) with tax cuts to persuade businesses and entrepeneurs to build, expand and generate money...

- Thundertaker

- Mayor

- Posts: 309

- Joined: Mon Aug 27, 2012 1:37 pm

- Gender:

- Has thanked: 14 times

- Been thanked: 3 times

- Political Leaning: Conservative

Who is online

Users browsing this forum: No registered users and 1 guest